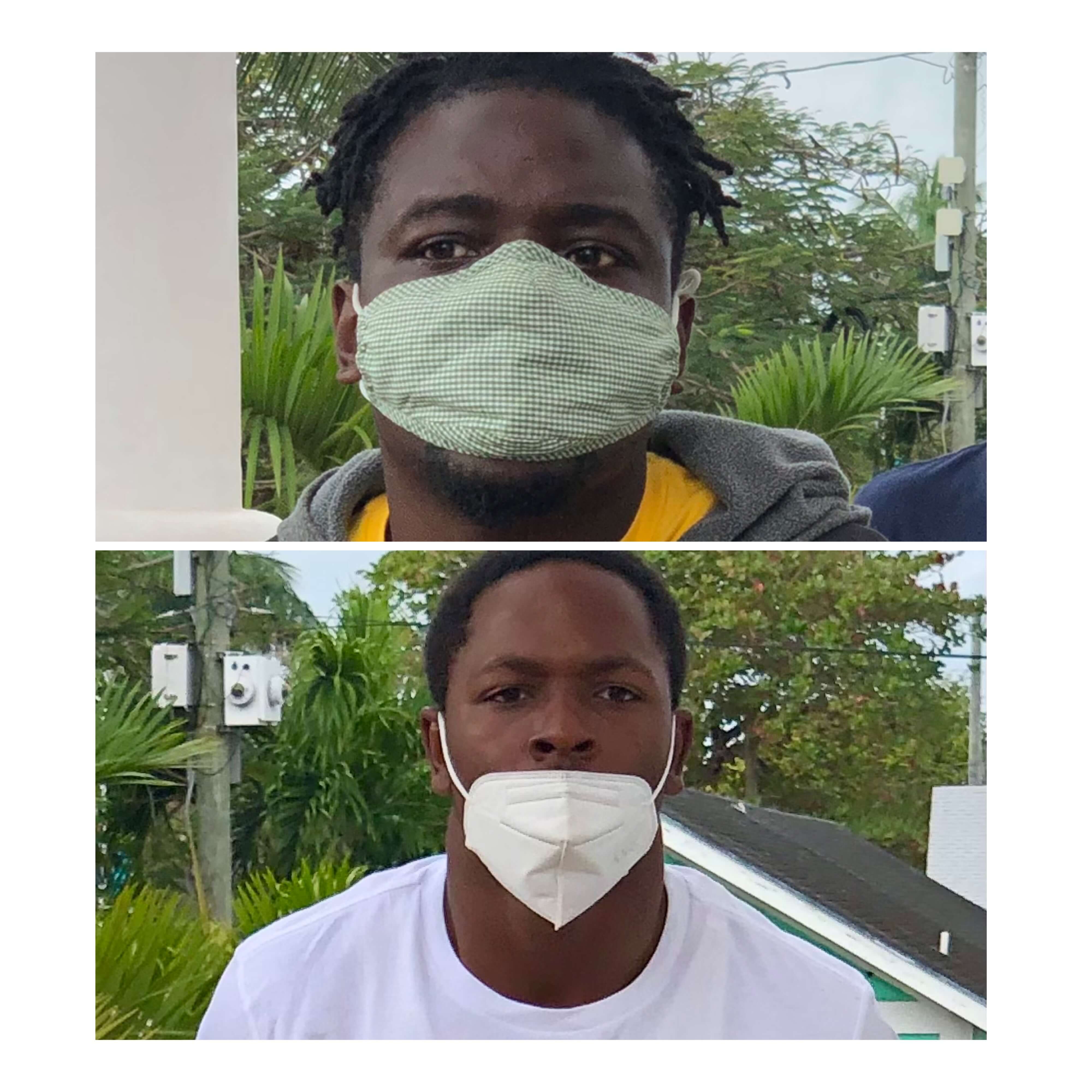

NASSAU- A Supreme Court judge has rejected a wrongful dismissal claim by three BPL employees accused of taking part in a scheme that cost the utility company $1.9 million.

Justice Ian Winder has ruled that the 2017 dismissals of Finance Division workers Tevaughn Miller, D’Yanndra Curry, and Katonia Neely for gross misconduct and dishonesty were just.

Justice Winder said, “I am not required to find that they were, in fact, guilty of misconduct as alleged, and I refrain from making such a finding. But on the evidence before the Court, I accept that it was open to BPL to hold such a belief, which I found it honestly held.”

Their dismissals followed a four-month-long investigation that began after the scheme came to light. BPL paid existing and fictional vendors close to $2million for work that was never done.

Justice Winder said, “I am satisfied that BPL conducted a full and fair investigation before dismissing the plaintiffs.”

BPL suspended the suspected employees with half pay during the investigation before they were summarily dismissed. They did not receive pay in lieu of notice.

Miller, Curry and Neely worked as a filing and records clerk, finance assistant and accounts payable clerk respectively.

In their claims for wrongful dismissal, they sought notice pay, contributions to health and pension plans, Christmas bonuses and damages.

Miller input $121,000 in bogus cheques

BPL said that Miller’s job gave him access to cheques and invoices, making it possible for him to participate in the scheme.

His job duties required him to maintain a complete and accurate log of all printed cheques.

However, a review of Miller’s cheque log revealed “that it was generally incomplete, making it impossible to trace the final whereabouts of the fraudulent checks prior to being reviewed.”

An IT report showed that Miller entered three fraudulent cheques made out to Bahamas Industrial Equipment, James Munroe Co. and Scuderia Electrical in the sum of $121,068.78

Additionally, Miller’s key card placed him on BPL’s grounds on his days off. He was at work on the day that one of the fraudulent cheques was deposited in the bank.

What is more, six fraudulent cheques were found in his work desk. When confronted with the allegations, Miller denied any wrongdoing.

Curry entered $1.4m fraudulent cheques

As for Curry, BPL’s investigation found her responsible for entering fraudulent invoices totalling $1,441,459.57. For her part, Curry said she did not find it suspicious that she singlehandedly inputted 25 fraudulent cheques.

The audit report also showed Curry entered six of the 13 fictitious vendors who received cheques into BPL’s accounts system. She also performed a first level review and signed off on five cheques which totalled $111,734.00.

On 10 May 2017, investigators found six fraudulent cleared cheques in her desk. However, Curry claimed that they never told her about the alleged discovery. In response, BPL said Curry “became agitated” and left before the interview ended.

Neely had ties to prime suspect

Meanwhile, BPL accused Neely of reviewing, signing off and stamping fraudulent cheques payable to Bahamas Heavy Machinery and Trucking for $23,000.00. Neely admitted investigators showed her the cheques and told her they were fraudulent.

She also admitted that she had a non-work relationship with former CIBC employee Reno Bethel, the primary suspect in the scheme. Bethel patronised Neely’s jewellery business. However, Neely said she could not share their phone messages she deleted them when her phone ran out of space.