NASSAU- A Supreme Court judge has ordered Scotiabank to refund a ZNS anchor $27,500 that was stolen from her savings account.

Macushla Pinder sued the bank after it refused to return the money, although police investigators concluded that she was likely the victim of a skimming scam.

The 17 disputed withdrawals were made at automated banking machines (ABMs) inside Rubis Service Stations in New Providence between September 5, 2015 and November 3, 2016.

Negligence

The bank, in its defense, claimed that the transactions were all the result of Pinder’s negligence. All of the transactions were performed while using Pinder’s PIN.

However, in a ruling last month, Justice Keith Thompson found the defense “unsustainable” and determined that the bank was at fault.

Justice Thompson ruled, “In the instant case, the plaintiff notified the defendant as soon as she became aware that funds were being withdrawn from her account. What is even more egregious is that even after notifying the defendant, further transactions took place. Therefore, in my view, it is the defendant who was seriously negligent.”

Edward Smith, who oversaw the bank’s security investigations, agreed that there was a delay between when Pinder made her complaint and when the branch asked his department to investigate her claims.

Pinder opened a joint account with her mother at the bank’s East Street and Soldier Road branch in 2009. She was issued a passbook and the only debit card linked to the account.

However, she never made withdrawals from the ABMs. Instead, she did her transactions inside the branch. However, Pinder did use her card to make small point of sale purchases.

The bank stopped updating passbooks in 2016. Justice Thompson said this took away Pinder’s ability to monitor her accounts herself.

When the bank discontinued updating passbooks, it advised clients to sign up for online banking. Pinder, however, did not avail herself of this service as it was not mandatory.

When Pinder went into the Palmdale branch to make a withdrawal on February 23, 2016, she asked the teller for her balance.

She requested a statement because the balance was much lower than she expected it to be.

On examining the statement, she noticed that between September 5, 2015 and February 19, 2016, persons unknown had stolen $17,500 from her account.

Bahamian withdrawals made while client was in New York

The unauthorized transactions were made at ABMs located at Rubis gas stations throughout New Providence. She realized that four withdrawals at the service station ABMs on December 23, 28, 29, 30 of 2015 took place while she was on vacation in New York.

She had the card with her during that trip and her statement showed that she had used it to make several point of sale transactions in New York on those same dates.

At the time, the daily withdrawal limit at the ABM was $1,000. Despite this, Pinder said that two ABM withdrawals of $1,000 each were made on December 21, 2015 and January 4, 2016.

An investigation showed that the withdrawals were made using the plaintiff’s debit card and PIN. The plaintiff asserted that she had never shared her PIN with anyone.

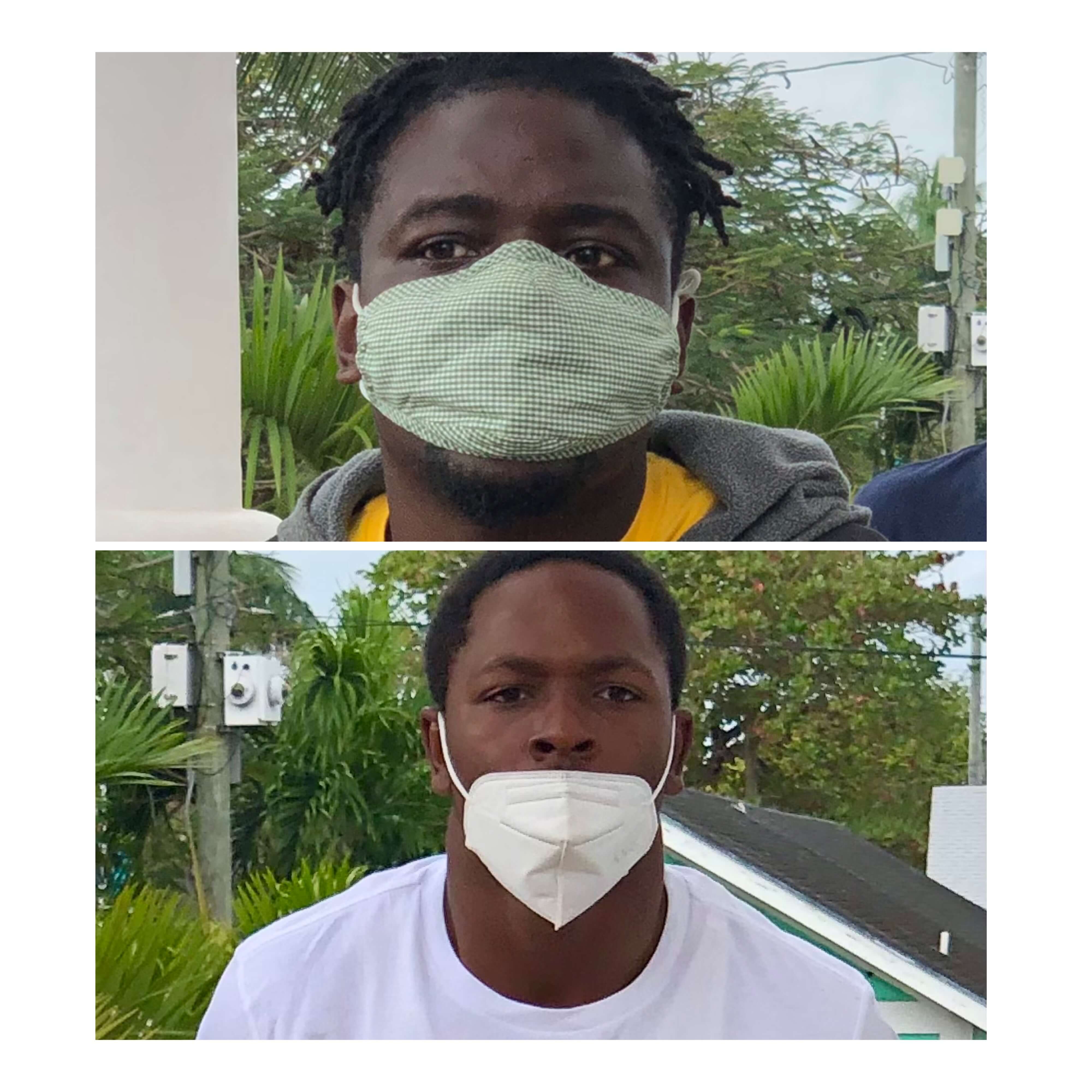

Security footage from the stations did not show Pinder at any of the ABMs. Pinder also denied recognising anyone who entered the station at the time the transactions were made.

Misplaced debit card

At the time that Pinder disputed the transactions, the bank said that Pinder said she had misplaced her debit card. This prompted the claim that she had breached her responsibility to report the card stolen in a timely manner.

She was issued a new card and she selected another PIN. When making an in-branch withdrawal on November 8, 2016, Pinder discovered that her balance was lower than expected.

She requested a statement and after reviewing it, she noticed that there were additional withdrawals made from Rubis ABMs.

Pinder closed the account and demanded the return of her money.